|

Eager Space | Videos by Alpha | Videos by Date | All Video Text | Support | Community | About |

|---|

Boeing Probe Intensifies over secret Lockheed Papers

https://www.seattletimes.com/business/boeing-probe-intensifies-over-secret-lockheed-papers/

https://www.reddit.com/r/SpaceXLounge/comments/17rl490/the_full_breakdown_of_nssl_phase_2_mission_awards/

Back in March of 2023, aerospace insider Eric Berger broke the story that United Launch Alliance was up for sale.

That led to a lot of speculation about who might buy ULA, and yet here we are, 17 months later, and it appears that there was no deal that all the parties agreed to.

I thought it would be interesting to talk about why companies acquire other companies, how that process works, and what might be going on with the possible sale of ULA.

It's common for specific rocket industry companies - or parts of companies - to be sold from one company to another.

For example, Rocket Lab bought

Sinclair Interplanetary (2020)

Advanced Solutions (2021)

Planetary Systems Corporation (2021)

SolAero Technologies (2022)

Mynaric (2025)

SailGP (2025)

And just now, Geost.

Sometimes the path is long and complicated.

In 1929, Thiokol chemical corporation was founded and made rubber and related chemicals. In the 1940s, they worked with JPL and invented solid rocket motors.

In 1958 they merged with reaction motors, and early liquid fueled rocket company.

In 1974, they won the contract to build solid rocket motors for the Space Shuttle.

In 1982, they merged with the Morton salt company to form Morton Thiokol

That lasted for 7 years, at which point Thiokol split off.

In 1998, they changed their name to cordant technologies and two years later, merged with parts of Alcoa corporation and two other companies to form AIC group. There are numerous companies with that name, so no logo...

In 2001, Alliant Techsystems - which came from Honeywell's defense business - bought Cordant. In 2006, they attempted to rename the solid rocket motor division to ATK Launch systems, though pretty much everybody just called it "Thiokol".

In 2024 Orbital sciences bought part of atk and created Orbital ATK, and then finally, in 2018, Orbital ATK was purchased by Northrop Grumman, to become Northrop grumman innovation systems.

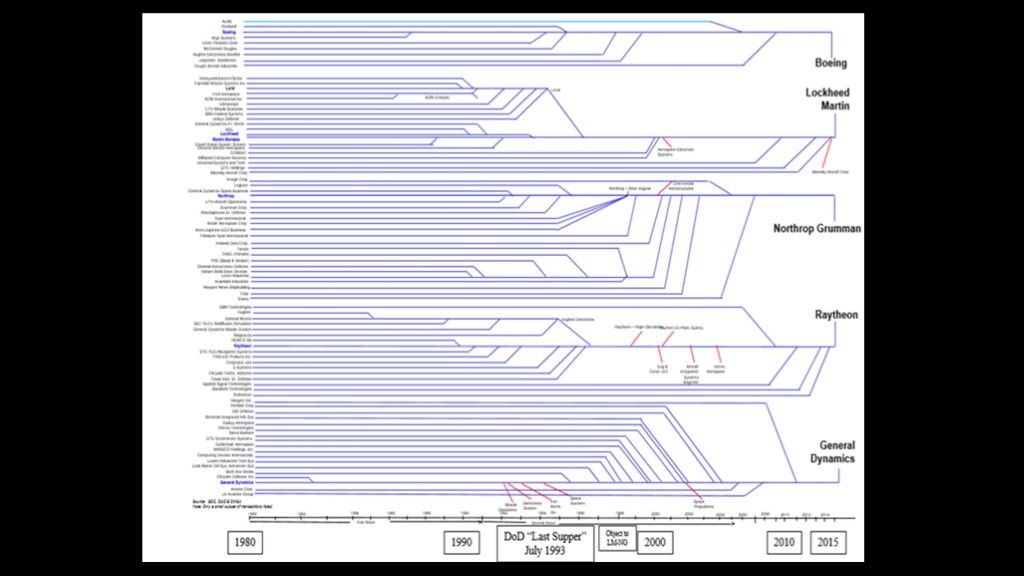

From an industry perspective, many companies have been absorbed into the big 5 defense primes.

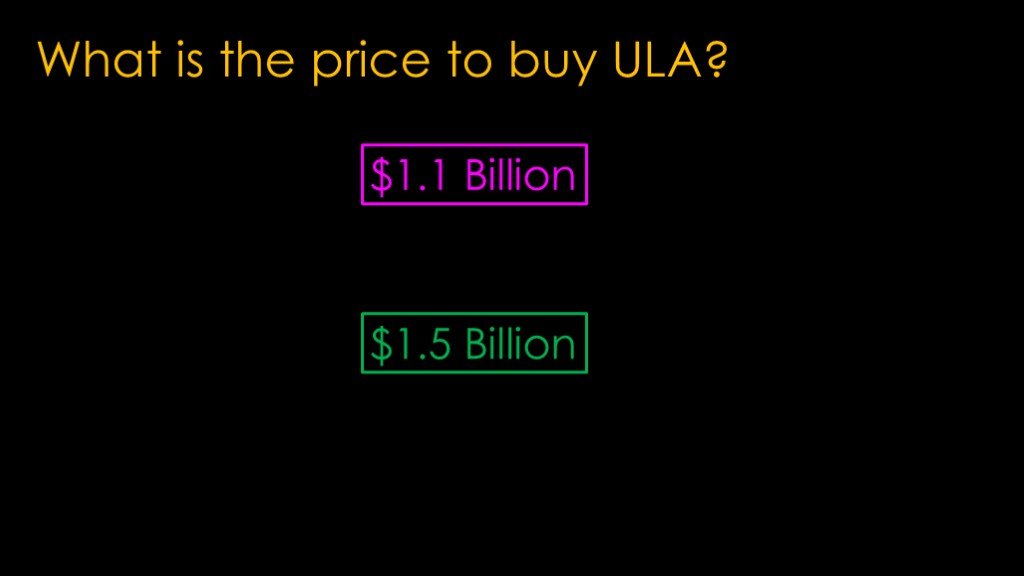

Getting back to ULA, the the first question people generally ask is "how much is ULA worth?", and that answer is simple.

We don't know.

In the real world, the world of mergers and acquisitions, there is a long process known as "due diligence", which is a deep investigation of the company you want to buy, and that generally involves look at the private details of the company, including the financials. That's a long winded way of saying that ULA has a decent idea of what they are worth and so would somebody who is seriously trying to buy them, but we don't.

The stated point of due diligence is to assess risks and make informed decisions, but there can be political reasons internal to the acquiring company that may cause them to acquire a company that's not a great deal or to skip acquiring a company that would be a great deal. News flash - many company decisions have nothing to do with company success.

That answer is truly no fun at all.

Can we guess how much ULA is worth? Yes.

We can create a model.

We will need to know the cost per flight of the vehicle for each configuration, the expected cost improvement at higher flight rates, the required configuration for every launch, the fixed costs allocation to each flight (found by taking the total fixed costs per year and dividing it by the number of flights in a year), the extra cost of the mission assurance required by the space force for NSSL flights, and other factors I didn't think of.

I don't know how to determine #1, #2, #3, #4, or #5, so I think the idea of modeling this is dead in the water. I tried to do it with estimates and the results were embarrassingly bad.

It turns out there is another source.

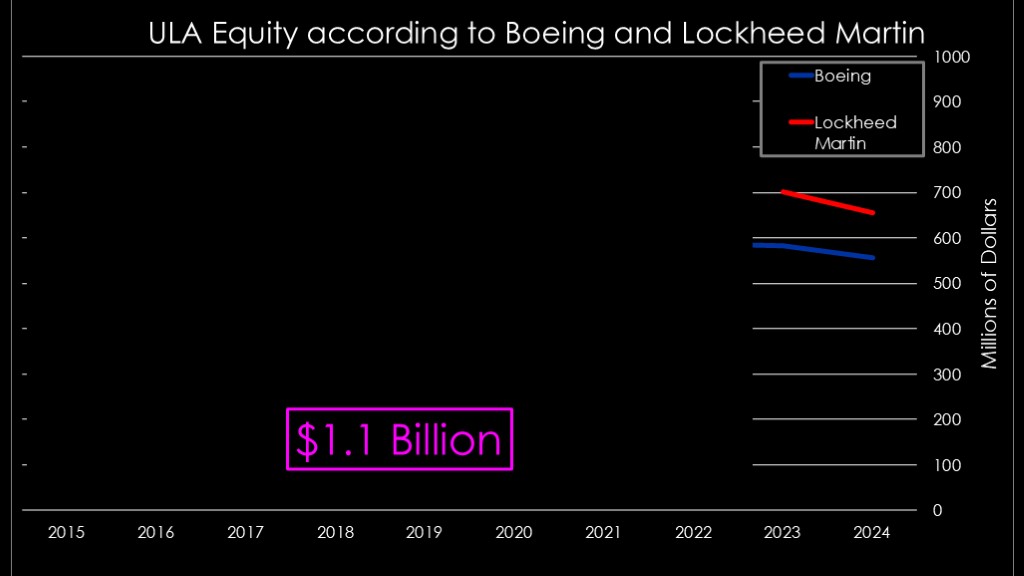

ULA is privately held and therefore they don't need to publish any of their financials, but both Boeing and Lockheed are publicly held, and that means they must publish information in their annual reports.

Digging into the reports, here's what we find.

In 2023, Boeing valued ULA at $582 million and in 2024, they valued it at $557 million.

The Lockheed martin values were slightly higher, at $701 and 654 million dollars, but that included some other equity investments and therefore the Boeing number will be lower than the Lockheed martin number. I'm therefore inclined to accept the Boeing number, and that means that at the end of 2024, ULA was valued at twice that number, or $1.1 billion.

I was pretty sure people would want to know what the previous values were, and here's the rest of the graph. In 8 years, the equity value of ULA had declined from about $1.8 billion to $1.1 billion, a drop of about 40%.

Perhaps surprisingly, the value that the owner puts on the business is not the same as an acceptable price.

There can be a lot of downsides of selling a company or part of a company to another company and it's both costly and a hassle. The sellers want to be compensated for the extra hassle, and they will therefore demand more.

The buyer is often looking for synergy with their current business - that's certainly the case with the companies that rocket lab acquired - and that may bump the price up.

If there are multiple buyers, the price will go up until one of those buyers drops out, and that could be significantly more than the number the owner started at.

The "number that we'll sell for" could easily be $1.5 billion or more.

Now we can talk about who might buy ULA.

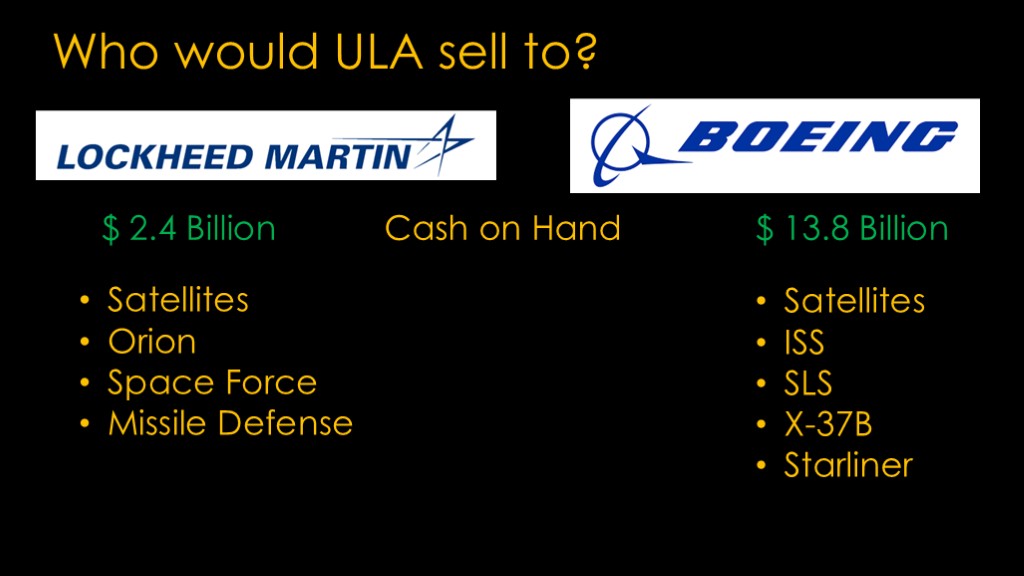

As a jointly owned company, it makes sense that Lockheed martin or boeing might want to buy out their partner and get full ownership of ULA.

Lockheed Martin finished 2024 with $2.4 billion of cash on hand. Lockheed can *easily* afford to buy out Boeing.

With Boeing's well-publicized financial problems, I expected them to be unable to buy out Lockheed Martin, but in October of 2024, Boeing raised $21.1 billion by selling new stock. They have plenty of cash to buy out their partner, though they might choose to conserve it at this point.

But there are two problems with the idea of a buyout...

The first is that the two companies have space portfolios that overlap - they cooperate on ULA, but they compete in a number of other areas. If Boeing sells to Lockheed Martin, Lockheed Martin now has a cost advantage as they will only pay launch costs and Boeing will pay the retail price for launches, and they will also not get preferred scheduling. Is it worth $600 million if it makes the already dominant Lockheed martin more dominant?

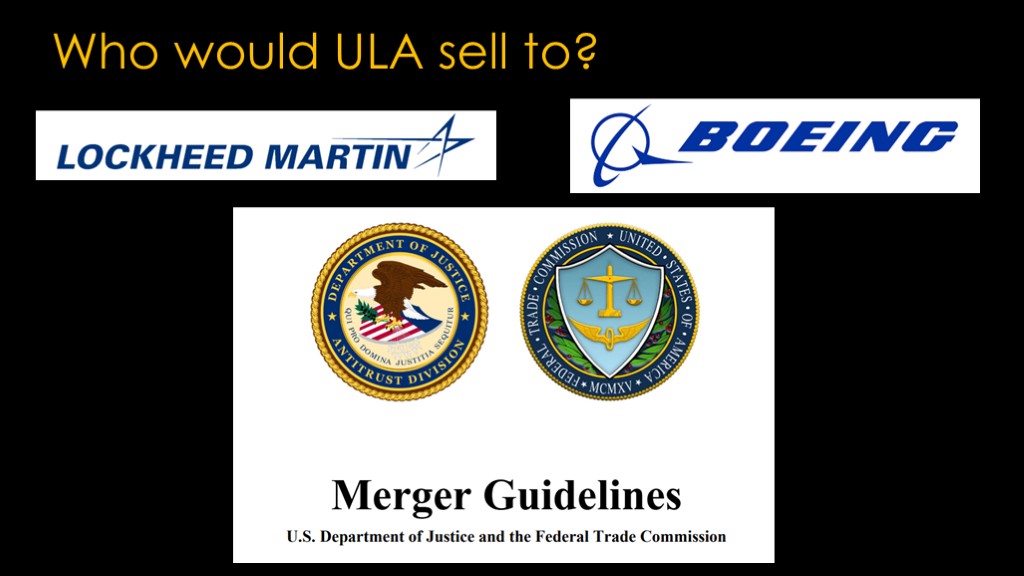

The second issue is antitrust law. The federal trade commission and the antitrust division of the department of justice get to have their say on whether a merger is going to be allowed, and it can easily be argued that having one company buy out the other reduces competition as it disadvantages the other companies in the industry. Back in 2022, the FTC sued to block Lockheed Martin's $4.4 billion acquisition of engine manufacturer aerojet rocketdyne.

Antitrust enforcement varies from administration to administration, and if you think you know what the current administration will do, I have some land to sell you. It's a great location - easy access to open water and the gulf of whatever.

It's unlikely that one partner is trying to buy out the other, because it would give advantage to the other and because they could just negotiate in private and announce the buyout when they an agreement.

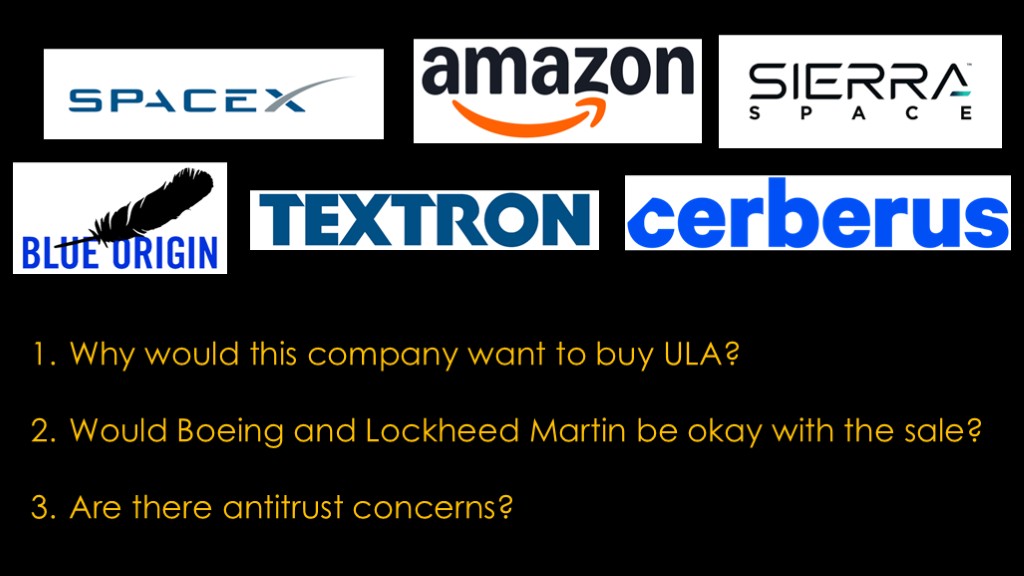

Who are the other possibilities?

Here are the names that I came up with. For each of these, we need to ask three questions.

Let's start with SpaceX. They are currently flying Falcon 9 and Falcon Heavy, and are focused on Starship.

Adding Vulcan centaur to their fleet doesn't add any new capability, but it does add a lot of complexity and brings in a company with a very different culture than SpaceX. It would garner them all the NSSL contracts that Vulcan currently holds but also put SpaceX on the hook to fly them on Vulcan, a rocket that isn't flying very often right now.

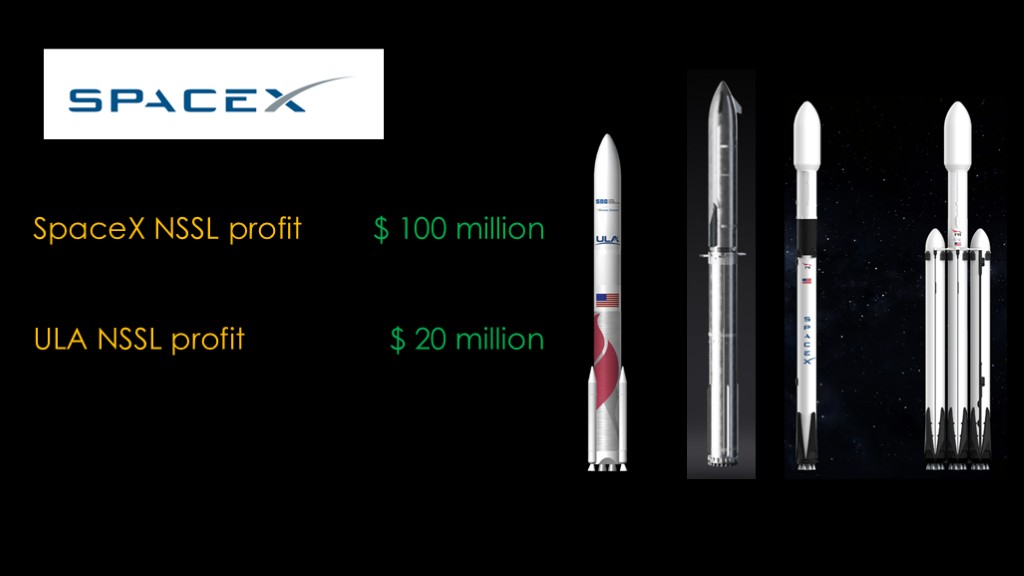

My guess is that the SpaceX profit on NSSL launches on Falcon 9 is about $100 million because their flight rate is so high right now, and ULA profit on Vulcan is likely closer to $20 million because their flight rate is so low.

It costs SpaceX nothing to hope for more NSSL flights to be moved to Falcon 9 and each one is much more lucrative than spending a bunch of money on Vulcan for a much lower profit.

I'm not sure what would happen with the Kuiper launch contracts. Falcon 9 would obviously be a much cheaper vehicle than Vulcan even if SMART reuse is a reality and they are flying all the time, but Amazon didn't make their launch provider choices based on economy, so that contract might go away.

Both Boeing and Lockheed Martin have flown on Falcon 9 so I don't think they would care a ton.

DoD would be very unhappy if this happened - they know what paying a monopoly provider is like from their past history when ULA was the only game in town and they would lose company redundancy, though they would still have rocket redundancy.

I see pretty much zero chance of SpaceX buying ULA; I don't see what Vulcan would add.

Cerberus is a private equity fund that has a long list financial services, healthcare, real estate, travel, and another 15 business areas.

In October of 2019, Cerberus bought the Paul Allen aerial rocket company stratolaunch, which had built the biggest plane ever. It was planned to carry rocket payloads on a Pegasus derived vehicle into orbit.

They pivoted from the orbital launcher plan to focusing on their Talon-A vehicle to be used for testing hypersonic technologies.

Since they don't have a lot of defense contracts, Cerberus is that kind of company that Boeing and Lockheed Martin would probably be okay with, and it's unlikely antitrust concerns would come up. But that's also a disadvantage - buying ULA wouldn't provide them with any specific synergy with their existing products or other advantages.

Textron owns a lot of companies in the aviation area, but they don't do anything in space as far as I can tell. I don't see any reason they would want to buy a launch company as it doesn't really fit into the kinds of things that they do.

Like Cerberus, I think this is the sort of sale that could take place.

That leaves us with three companies.

Would Blue Origin want to adopt a smaller brother to New Glenn?

Vulcan will likely ramp up faster than New Glenn, but New Glenn has a much better reuse story and therefore will likely be cheaper, plus Blue Origin has been architecting other programs based on New Glenn. They would probably fly NSSL on Vulcan, but they might try not to fly Kuiper if New Glenn ended up being cheaper. I therefore don't really understand what sort of synergy they would gain through this purpose, and it overlaps with the NSSL capability that they are developing for New Glenn.

I don't think Boeing or Lockheed Martin would have a problem with this sale, and DoD would probably be okay with it.

My evaluation is that Vulcan doesn't add a lot for Blue Origin and it could easily be a distraction. It could perhaps provide a bunch of experience employees to help ramp up New Glenn.

What about Amazon?

Starlink has its own rocket, and that has given SpaceX a competitive advantage cause starlink launches at cost rather than at retail price. Why shouldn't Kuiper have their own rocket? Wouldn't that help?

But SpaceX gets benefit both because they own the Falcon 9 and because it's the cheapest rocket around.

Vulcan's reuse story is less compelling than that of New Glenn or Neutron, so it's entirely possible that Amazon could buy ULA only to find out that their internal cost per satellite launched is more with ULA than it would be if you just paid to have the launches done on New Glenn or Neutron. At that point they will have bought a launcher company that they had no real use for.

Boeing and Lockheed Martin would likely be okay with this. DoD would probably hate it because that ULA already puts a higher priority on Kuiper launches than NSSL launches, and that is likely to get much worse under Amazon ownership.

Finally, we get to sierra space. They are currently working on getting their dream chaser ISS resupply vehicle ready for its first flight, and that will be a flight on Vulcan.

This is another company where a sale could go through but I don't see much reason for them to want to buy Vulcan. Dream chaser is their big product but the initial NASA contract is only for 7 flights and it would cost the less if they flew it on Falcon 9.

Why hasn't anybody bought ULA?

The short answer is being a co-owned entity makes it really, really hard to find a company that wants to buy and is acceptable to both owners.